Page 1 of 1

Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 8:21 am

by CitrusGender

Alright, I thought I would make a thread about this in hopes that somebody else out there was interested in investing. I've done some work for a portfolio for the past three years and I just wanted to get an idea as to what all of your opinions are on the current market state for equity and debt.

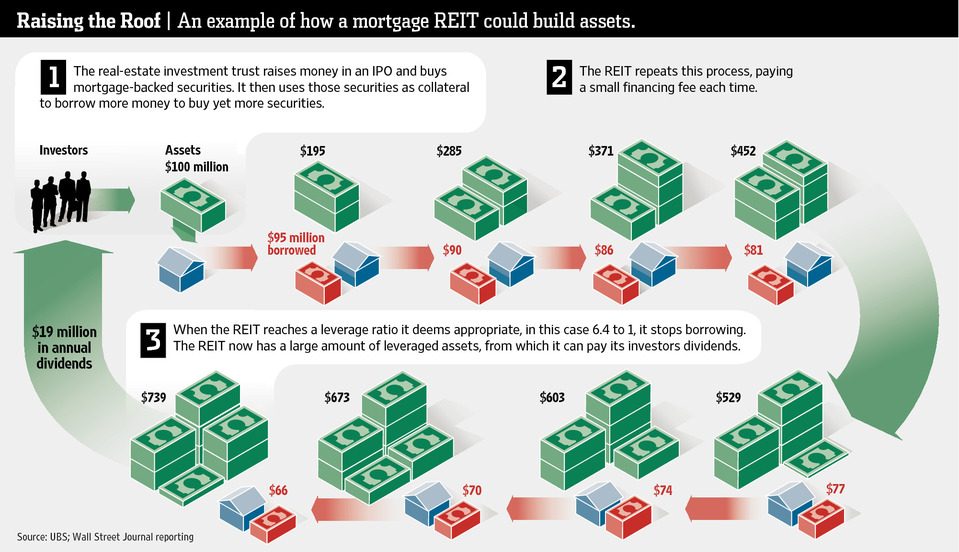

I've been doing a lot of research recently on equities that are likely to resist the upcoming increase to the federal funds rate in the future. Currently doing some research on Mortgage REITs and Equity REITs in general, pretty interesting stuff. The premise is extremely cool and the REIT I'm looking at right now has a huge upside.

Not going to lie though, my portfolio looked up some information showing that hedge funds and actively managed entities are really faltering in comparison to passive investment. Perhaps the day of the day trader will soon come to an end as everyone just goes long on index funds. That's how my family has been investing, atleast.

How about all of you, what's the word on the street?

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 9:48 am

by TheWiznard

whats a stork?

never messed with investing or anything like that too poorfag probably should though?

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 9:51 am

by DemonFiren

i can't trust any system that makes money from practically nothing

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 10:13 am

by CitrusGender

TheWiznard wrote:whats a stork?

never messed with investing or anything like that too poorfag probably should though?

kek

The underlying value behind a stock is that dividends are issued with the stock and the stock has the possiblity of appreciating in value. TECHNICALLY, the stock is valued at the present value sum of the dividend payments in the future.

in laymans terms:

You buy a part of a company and get money for your money you put down. The thing you buy may go up in value. You also get free money ussually four times a year from that money down.

DemonFiren wrote:i can't trust any system that makes money from practically nothing

you know, I inherently disagree with this statement. You make money on liquidity, the money you make is from not being able to use your money. If this type of system didn't exist, then there would never be any money to fund projects such as THE CONSTRUCTION OF YOUR COMPUTER/COMPUTER PARTS. Or literarly anything.

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 7:08 pm

by XSI

Usury is a sin

Repent

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 7:57 pm

by calzilla1

XSI wrote:Usury is a sin

Repent

Yes, a society destroying scurge pushed by jews. High intrest rates and ease of access are a things that kill nations and corrupt populouses. These are pestilence to a society and we need a cure! We need a final solution

Re: Investing news: Stocks and Bonds

Posted: Tue Oct 17, 2017 10:21 pm

by CitrusGender

calzilla1 wrote:XSI wrote:Usury is a sin

Repent

Yes, a society destroying scurge pushed by jews. High intrest rates and ease of access are a things that kill nations and corrupt populouses. These are pestilence to a society and we need a cure! We need a final solution

Like, if people did not have usury: there would be little to no reason to attempt to ensure a profit. This would cause a ton of non-profitable activities to take place or basically nothing would get funding since investors have no reason to plant their money. That is not how society works.

Re: Investing news: Stocks and Bonds

Posted: Wed Oct 18, 2017 10:50 pm

by Malkevin

And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 12:16 am

by 1g88a

DemonFiren wrote:i can't trust any system that makes money from practically nothing

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 2:35 am

by CitrusGender

Malkevin wrote:And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Sub prime mortgages was just the fault of people getting too aggressive with their investments. Although you are correct IF WE DIDN'T HAVE MORTGAGES, WE WOULDN'T HAVE SUB-PRIME MORTGAGES: But I can't imagine you would enjoy paying for a fucking house from out of pocket cash now, would you?

Credit is probably one of the best inventions that could ever exist due to the fact that it makes it possible for people who don't have money to be able to get the capital to make money. Imagine if we didn't extend credit, we would still have major projects of society reserved to rich people/ people who were friends of rich people. It's literarly the equalizing force.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 8:09 am

by Ikarrus

I just put shit into long term RRSPs and I get company stock as a purchase plan and bonus.

I should probably do more but I know fuck all. I’m actually surprised that I managed to own a car and house at all.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 12:55 pm

by Malkevin

CitrusGender wrote:Malkevin wrote:And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Sub prime mortgages was just the fault of people getting too aggressive with their investments. Although you are correct IF WE DIDN'T HAVE MORTGAGES, WE WOULDN'T HAVE SUB-PRIME MORTGAGES: But I can't imagine you would enjoy paying for a fucking house from out of pocket cash now, would you?

Credit is probably one of the best inventions that could ever exist due to the fact that it makes it possible for people who don't have money to be able to get the capital to make money. Imagine if we didn't extend credit, we would still have major projects of society reserved to rich people/ people who were friends of rich people. It's literarly the equalizing force.

Oh I don't know, pay rent?

What's the difference between paying a monthly amount to the landlord that owns your house compared to the bank that owns your house?

Also houses would be more affordable if their price weren't so over inflated from banks and investors using them as collateral and pushing the prices up so they can keep up the illusion of constant infinite growth

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 2:50 pm

by onleavedontatme

Malkevin wrote:CitrusGender wrote:Malkevin wrote:And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Sub prime mortgages was just the fault of people getting too aggressive with their investments. Although you are correct IF WE DIDN'T HAVE MORTGAGES, WE WOULDN'T HAVE SUB-PRIME MORTGAGES: But I can't imagine you would enjoy paying for a fucking house from out of pocket cash now, would you?

Credit is probably one of the best inventions that could ever exist due to the fact that it makes it possible for people who don't have money to be able to get the capital to make money. Imagine if we didn't extend credit, we would still have major projects of society reserved to rich people/ people who were friends of rich people. It's literarly the equalizing force.

Oh I don't know, pay rent?

What's the difference between paying a monthly amount to the landlord that owns your house compared to the bank that owns your house?

Also houses would be more affordable if their price weren't so over inflated from banks and investors using them as collateral and pushing the prices up so they can keep up the illusion of constant infinite growth

How is paying rent on a personal home a system that scales to "I invented a new widget and need money for machines/employees/advertising/a workspace/etc to start producing them."

DemonFiren wrote:i can't trust any system that makes money from practically nothing

????

If you buy a piece of ownership of my Burger Shop, and I use that money to open a 2nd Burger Shop and research blorble sauce, those are very real and tangible things. And if my business plan is sound and Burger Shop starts selling more, it will become worth more, and the piece you bought will become worth more.

The other half of "its not nothing" is that if everyone hated slime burgs and I sold none and went out of business the piece of Burger Shop you bought is worthless. You took on risk.

>but that is just gambling!

For the average person who doesn't have time to research all these companies in depth it probably is sure and you'd probably be better off just buying index funds. Like Citrus, said, most traders fail to beat the market.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 3:31 pm

by Drynwyn

1g88a wrote:DemonFiren wrote:i can't trust any system that makes money from practically nothing

Ah, but it is merely an illusion, albeit one facilitated by both society and the nature of money, that the capital investment itself produces money. In reality, you are simply purchasing the right to a certain fraction of the surplus value which the capitalist class in the future intends to extract from labor power. The money itself is not produced by money-it is produced by labor power.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 3:35 pm

by Oldman Robustin

l o l @ thinking "having time to research in-depth" is enough to beat the market.

Portfolio managers get paid hefty sums of money to devote all their time PLUS experience and education to beating the market and they still can't do it.

You need an insight. Something the rest of the investing world hasn't figured out. I've got a finance degree and the one thing I will never do is actually utilize all the ratios and tools I learned for 4 years - there's already AI and professionals out there who live, eat, and breathe this stuff with more data than any individual will ever possess. Having "time" to do research with publicly available info and trying to daytrade off that is just gambling with a side of delusion.

There are exceptions but those are so rare and so outside of the ordinary case that mentioning them isn't even worth it because them inspires false hope in a legion of wannabee self-fashioned geniuses.

Edit: There's nothing inherently wrong with gambling, if you want to daytrade because it entertains you even though it will cost you money in the long run, and you're not making excessively risky investments, go for it... just don't associate your good returns with anything more than dumb luck.

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 3:58 pm

by calzilla1

If you think about it, money is practically nothing

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 6:42 pm

by cedarbridge

calzilla1 wrote:If you think about it, money is practically nothing

“This planet has - or rather had - a problem, which was this: most of the people living on it were unhappy for pretty much of the time. Many solutions were suggested for this problem, but most of these were largely concerned with the movement of small green pieces of paper, which was odd because on the whole it wasn't the small green pieces of paper that were unhappy.”

Re: Investing news: Stocks and Bonds

Posted: Thu Oct 19, 2017 7:38 pm

by Malkevin

Kor wrote:Malkevin wrote:CitrusGender wrote:Malkevin wrote:And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Sub prime mortgages was just the fault of people getting too aggressive with their investments. Although you are correct IF WE DIDN'T HAVE MORTGAGES, WE WOULDN'T HAVE SUB-PRIME MORTGAGES: But I can't imagine you would enjoy paying for a fucking house from out of pocket cash now, would you?

Credit is probably one of the best inventions that could ever exist due to the fact that it makes it possible for people who don't have money to be able to get the capital to make money. Imagine if we didn't extend credit, we would still have major projects of society reserved to rich people/ people who were friends of rich people. It's literarly the equalizing force.

Oh I don't know, pay rent?

What's the difference between paying a monthly amount to the landlord that owns your house compared to the bank that owns your house?

Also houses would be more affordable if their price weren't so over inflated from banks and investors using them as collateral and pushing the prices up so they can keep up the illusion of constant infinite growth

How is paying rent on a personal home a system that scales to "I invented a new widget and need money for machines/employees/advertising/a workspace/etc to start producing them."

I was responding to the first sentence i quoted

Re: Investing news: Stocks and Bonds

Posted: Sat Oct 21, 2017 11:42 pm

by CitrusGender

Malkevin wrote:CitrusGender wrote:Malkevin wrote:And we wouldn't have boom and bust economies like with sub prime mortgages, world economy is still fucked from that - cheers Shylocks.

Sub prime mortgages was just the fault of people getting too aggressive with their investments. Although you are correct IF WE DIDN'T HAVE MORTGAGES, WE WOULDN'T HAVE SUB-PRIME MORTGAGES: But I can't imagine you would enjoy paying for a fucking house from out of pocket cash now, would you?

Credit is probably one of the best inventions that could ever exist due to the fact that it makes it possible for people who don't have money to be able to get the capital to make money. Imagine if we didn't extend credit, we would still have major projects of society reserved to rich people/ people who were friends of rich people. It's literarly the equalizing force.

Oh I don't know, pay rent?

What's the difference between paying a monthly amount to the landlord that owns your house compared to the bank that owns your house?

Also houses would be more affordable if their price weren't so over inflated from banks and investors using them as collateral and pushing the prices up so they can keep up the illusion of constant infinite growth

Do you ever want to own your home? Yes rent is nice because you get it for a lower rate, but still you never will own that home. (You're essentially paying for the interest/appreciation on that property if you are renting since you are not gaining any equity). I thought about your second comment, I can't tell you that I know too much about using homes as collateral. I know that is a problem in some areas like China and Las Vegas due to the fact that tons of homes are vacant but the banks will still have high values on them (though this is ultimately down to the skill of the appraiser to make sure the price is adequately portrayed). Either way, if a bank is using a home as collateral and the property in itself is not desirable: the price of the property will go down.

Drynwyn wrote:1g88a wrote:DemonFiren wrote:i can't trust any system that makes money from practically nothing

Ah, but it is merely an illusion, albeit one facilitated by both society and the nature of money, that the capital investment itself produces money. In reality, you are simply purchasing the right to a certain fraction of the surplus value which the capitalist class in the future intends to extract from labor power. The money itself is not produced by money-it is produced by labor power.

calzilla1 wrote:If you think about it, money is practically nothing

Re: Investing news: Stocks and Bonds

Posted: Sun Oct 22, 2017 12:43 am

by lntigracy

Buy bitcoin

Re: Investing news: Stocks and Bonds

Posted: Sun Oct 22, 2017 6:13 am

by Drynwyn

I think Ethereum is a better investment at the moment.

Re: Investing news: Stocks and Bonds

Posted: Sun Oct 22, 2017 11:32 am

by XSI

Bitcoin has been going up so far

I'm not sure if it's a good investment or not, but it seems like cryptocurrency as a whole is an interesting thing and we should probably consider the idea of currencies like it becoming widespread

And I'm not saying that because it will get us closer to actually having credsticks

Re: Investing news: Stocks and Bonds

Posted: Sun Oct 22, 2017 6:06 pm

by calzilla1

In other news, Soros has just invested 18B into one of his "charity" programs, making it the largest investmemt ever. He knows his time is up; Soro's final gambit. Also, watch for the DOW as it will start falling like a bird filled with buck shot

Re: Investing news: Stocks and Bonds

Posted: Fri Jan 05, 2018 9:46 pm

by Anonmare

Have I told you guys about bitcoins?